Net Asset Value

Daily NAV Change

Investment Strategy

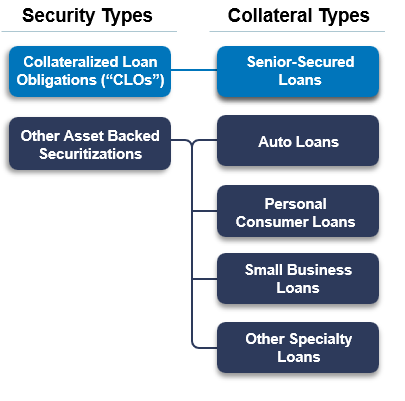

Prospect Enhanced Yield Fund, Inc (“PENF” or the “Fund”) is a closed-end, 1940 Act interval fund intended to generate income and long-term appreciation by investing in non-mortgage structured credit investments.

The Fund’s targeted structured credit instruments include asset backed securities (“ABS”), collateralized loan obligations (“CLOs”), and other securitized debt investments representing interests in cashflows from various assets, such as loans, leases, and warehouse facilities.

learn more about prospect enhanced yield fund’s

Strategic Advantages

With the non-mortgage ABS industry estimated at $1.7 trillion2, we believe significant opportunity for growth awaits

BB-rated CLO debt tranches and other ABS have historically offered attractive yields and lower defaults compared to traditional high yield bonds and loans

Attractive Yields & Lower Defaults

Varied Collateral & Borrower Types

Investments may hold 1,000 or more individual loans, providing exposure to a broad base of collateral and credit by borrower and industry, not just corporate backed

Target investments benefit from structural features including contractual collateral guarantees, overcollateralization, waterfall subordination structures, and third-party credit ratings

Structured Securities

Balanced Rate Exposure

Mix of floating and fixed rate debt provides balance during periods of interest rate changes

Asset Overview

Asset backed debt with minimal exposure overlap to real estate or private credit loans

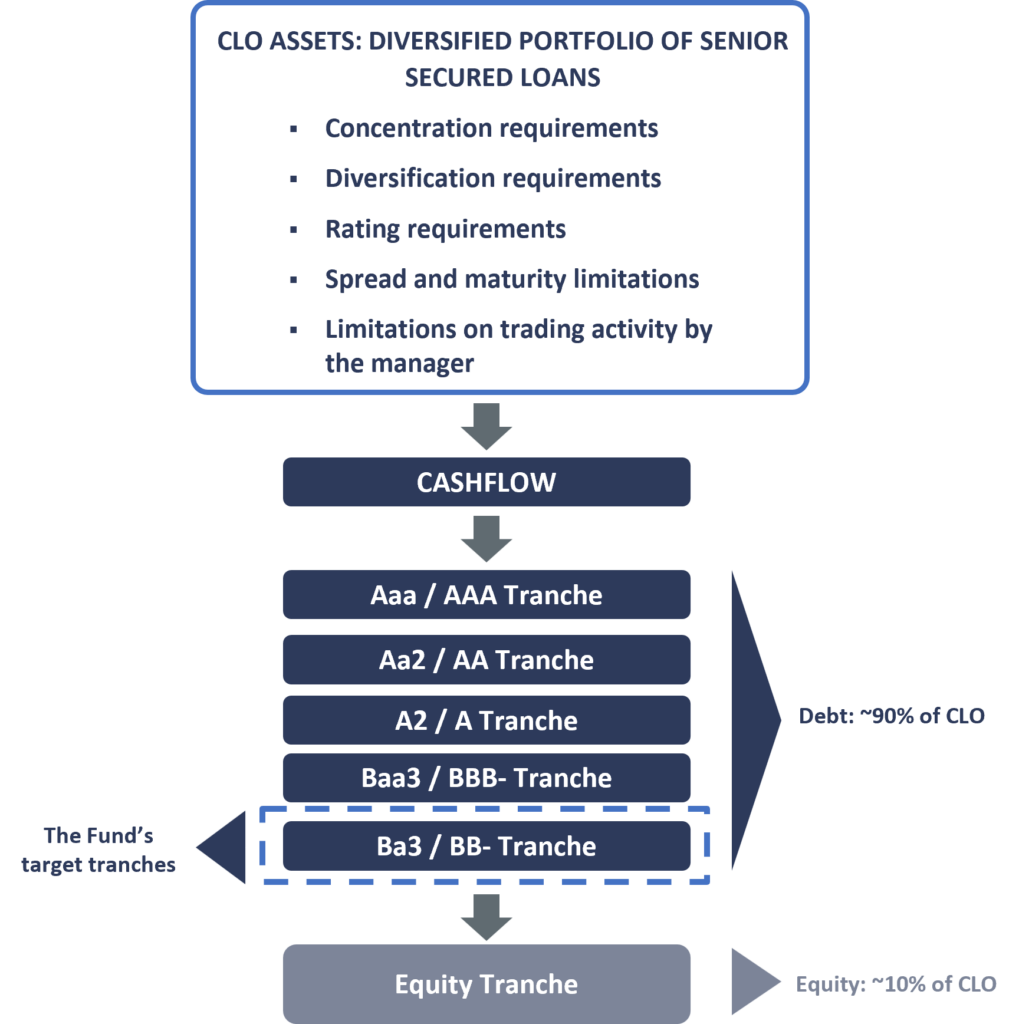

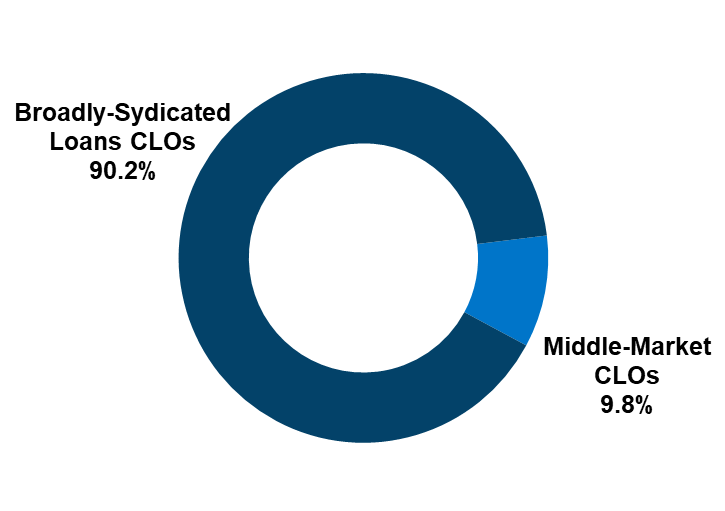

Collateralized Loan Obligations are a type of structured credit product secured by a pool of first lien senior secured loans typically made to large companies.

Features of Senior Secured Loans:

- Highest priority in the capital structure

- Senior to unsecured and subordinated debt, preferred stock, and common stock

- Floating rates and SOFR floors

- Large Borrowers

- Average loan size of $1.0+ billion

- EBITDA of $100+ million

- Rated by Moody’s and S&P

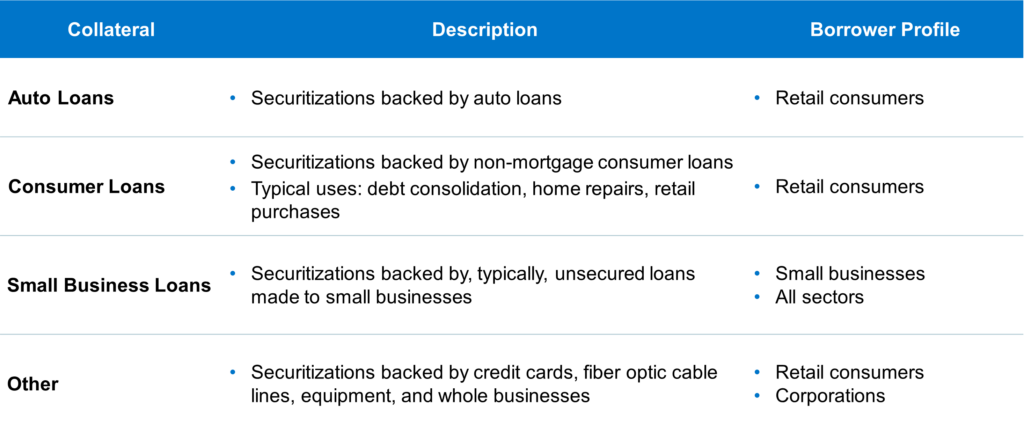

Asset Backed Securities are collateralized by the cashflows from a pool of income-generating debt instruments, including consumer loans, leases, credit card balances, and other niche sources of financing.

Features of Asset Backed Securities:

- Investments may hold 1,000 or more individual loans, providing exposure to a broad base of collateral and credit by borrower and industry

- No underlying exposure to Real Estate

- Securitizations often feature structural credit enhancements like overcollateralization, excess spread, or seniority in payment prioritization

as of December 31, 2025

Fund Details

Assets Under Management

$29M

# of Investments

29

# of Underlying Loans

~1,900

The Fund’s experienced management team has historically invested over $3.7B in structured credit investments

Current Portfolio by Underlying Loan Type3

Performance

| id | Cusip | Fund No | Fund | Date | Net Assets | Net Asset Value (NAV) | Prior NAV | Daily NAV % Change | Distribution Factor | 1-Month Return (Gross) | R_Fd_3_Month_NoLoad | R_Fd_6_Month_NoLoad | R_Fd_CYTD_NoLoad | R_Fd_FYTD_NoLoad | R_Fd_1Yr_NoLoad | R_Fd_3Yr_NoLoad | R_Fd_5Yr_NoLoad | R_Fd_10Yr_NoLoad | Since Inception Annualized (Gross) | Since Inception Cumulative (Gross) | 1-Month Return (Net) | R_Fd_3_Month_Load | R_Fd_6_Month_Load | R_Fd_CYTD_Load | R_Fd_FYTD_Load | R_Fd_1Yr_Load | R_Fd_3Yr_Load | R_Fd_5Yr_Load | R_Fd_10Yr_Load | Since Inception Annualized (Net) | Since Inception Cumulative (Net) |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 115 | 74350T305 | 28061 | Prospect Enhanced Yield Fund – I | 2026-02-27 | 28849923.83 | 24.28 | 24.78 | -0.50 | 0.19 | -2.90 | -0.96 | 0.59 | -1.89 | 0.87 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.87 | -2.90 | -0.96 | 0.59 | -1.89 | 0.87 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.87 |

| 114 | 74350T305 | 28061 | Prospect Enhanced Yield Fund – I | 2026-02-26 | 29450242.12 | 24.78 | 24.79 | -0.01 | 0.00 | -1.63 | 0.30 | 1.86 | -0.65 | 2.15 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 2.15 | -1.63 | 0.30 | 1.86 | -0.65 | 2.15 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 2.15 |

| 113 | 74350T305 | 28061 | Prospect Enhanced Yield Fund – I | 2026-02-25 | 29460924.22 | 24.79 | 24.79 | 0.00 | 0.00 | -1.59 | 0.38 | 1.94 | -0.61 | 2.19 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 2.19 | -1.59 | 0.38 | 1.94 | -0.61 | 2.19 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 2.19 |

| 112 | 74350T305 | 28061 | Prospect Enhanced Yield Fund – I | 2026-02-24 | 29452889.08 | 24.79 | 24.78 | 0.01 | 0.00 | -1.59 | 0.34 | 1.94 | -0.61 | 2.19 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 2.19 | -1.59 | 0.34 | 1.94 | -0.61 | 2.19 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 2.19 |

| 111 | 74350T305 | 28061 | Prospect Enhanced Yield Fund – I | 2026-02-23 | 29446750.23 | 24.78 | 24.78 | 0.00 | 0.00 | -1.63 | 0.34 | 1.90 | -0.65 | 2.15 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 2.15 | -1.63 | 0.34 | 1.90 | -0.65 | 2.15 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 2.15 |

| 110 | 74350T305 | 28061 | Prospect Enhanced Yield Fund – I | 2026-02-20 | 29440285.98 | 24.78 | 25.06 | -0.28 | 0.00 | -1.36 | 0.42 | 1.98 | -0.65 | 2.15 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 2.15 | -1.36 | 0.42 | 1.98 | -0.65 | 2.15 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 2.15 |

| 109 | 74350T305 | 28061 | Prospect Enhanced Yield Fund – I | 2026-02-19 | 29774100.45 | 25.06 | 25.05 | 0.01 | 0.00 | -0.20 | 1.31 | 3.14 | 0.47 | 3.30 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 3.30 | -0.20 | 1.31 | 3.14 | 0.47 | 3.30 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 3.30 |

| 108 | 74350T305 | 28061 | Prospect Enhanced Yield Fund – I | 2026-02-18 | 29765272.76 | 25.05 | 25.04 | 0.01 | 0.00 | -0.24 | 1.27 | 3.14 | 0.43 | 3.26 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 3.26 | -0.24 | 1.27 | 3.14 | 0.43 | 3.26 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 3.26 |

| 107 | 74350T305 | 28061 | Prospect Enhanced Yield Fund – I | 2026-02-17 | 29757339.11 | 25.04 | 25.04 | 0.00 | 0.00 | -0.28 | 1.27 | 3.10 | 0.39 | 3.22 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 3.22 | -0.28 | 1.27 | 3.10 | 0.39 | 3.22 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 3.22 |

| 106 | 74350T305 | 28061 | Prospect Enhanced Yield Fund – I | 2026-02-13 | 29750970.61 | 25.04 | 25.01 | 0.03 | 0.00 | -0.09 | 1.39 | 3.14 | 0.39 | 3.22 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 3.22 | -0.09 | 1.39 | 3.14 | 0.39 | 3.22 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 3.22 |

| 105 | 74350T305 | 28061 | Prospect Enhanced Yield Fund – I | 2026-02-12 | 29717947.81 | 25.01 | 24.99 | 0.02 | 0.00 | -0.13 | 1.23 | 3.05 | 0.27 | 3.10 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 3.10 | -0.13 | 1.23 | 3.05 | 0.27 | 3.10 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 3.10 |

| 104 | 74350T305 | 28061 | Prospect Enhanced Yield Fund – I | 2026-02-11 | 29699237.99 | 24.99 | 24.98 | 0.01 | 0.00 | -0.17 | 1.15 | 2.97 | 0.19 | 3.01 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 3.01 | -0.17 | 1.15 | 2.97 | 0.19 | 3.01 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 3.01 |

| 103 | 74350T305 | 28061 | Prospect Enhanced Yield Fund – I | 2026-02-10 | 29687430.45 | 24.98 | 24.98 | 0.00 | 0.00 | -0.21 | 1.15 | 2.93 | 0.15 | 2.97 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 2.97 | -0.21 | 1.15 | 2.93 | 0.15 | 2.97 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 2.97 |

| 102 | 74350T305 | 28061 | Prospect Enhanced Yield Fund – I | 2026-02-09 | 29685930.25 | 24.98 | 24.97 | 0.01 | 0.00 | -0.21 | 1.19 | 2.93 | 0.15 | 2.97 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 2.97 | -0.21 | 1.19 | 2.93 | 0.15 | 2.97 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 2.97 |

| 101 | 74350T305 | 28061 | Prospect Enhanced Yield Fund – I | 2026-02-06 | 29677011.92 | 24.97 | 25.27 | -0.30 | 0.00 | -0.05 | 1.27 | 0.00 | 0.11 | 2.93 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 2.93 | -0.05 | 1.27 | 0.00 | 0.11 | 2.93 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 2.93 |

| 100 | 74350T305 | 28061 | Prospect Enhanced Yield Fund – I | 2026-02-05 | 30031081.08 | 25.27 | 25.28 | -0.01 | 0.00 | 1.15 | 2.53 | 0.00 | 1.31 | 4.17 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 4.17 | 1.15 | 2.53 | 0.00 | 1.31 | 4.17 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 4.17 |

| 99 | 74350T305 | 28061 | Prospect Enhanced Yield Fund – I | 2026-02-04 | 30038697.30 | 25.28 | 25.27 | 0.01 | 0.00 | 1.23 | 2.61 | 0.00 | 1.35 | 4.21 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 4.21 | 1.23 | 2.61 | 0.00 | 1.35 | 4.21 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 4.21 |

| 98 | 74350T305 | 28061 | Prospect Enhanced Yield Fund – I | 2026-02-03 | 30030447.61 | 25.27 | 25.26 | 0.01 | 0.00 | 1.19 | 2.61 | 0.00 | 1.31 | 4.17 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 4.17 | 1.19 | 2.61 | 0.00 | 1.31 | 4.17 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 4.17 |

| 97 | 74350T305 | 28061 | Prospect Enhanced Yield Fund – I | 2026-02-02 | 30013431.59 | 25.26 | 25.25 | 0.01 | 0.00 | 1.15 | 2.61 | 0.00 | 1.27 | 4.13 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 4.13 | 1.15 | 2.61 | 0.00 | 1.27 | 4.13 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 4.13 |

| 96 | 74350T305 | 28061 | Prospect Enhanced Yield Fund – I | 2026-01-30 | 29811133.44 | 25.25 | 25.40 | -0.15 | 0.19 | 1.27 | 2.61 | 0.00 | 4.09 | 4.09 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 4.09 | 1.27 | 2.61 | 0.00 | 4.09 | 4.09 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 4.09 |

| 95 | 74350T305 | 28061 | Prospect Enhanced Yield Fund – I | 2026-01-29 | 29988371.98 | 25.40 | 25.40 | 0.00 | 0.00 | 1.11 | 2.45 | 0.00 | 3.92 | 3.92 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 3.92 | 1.11 | 2.45 | 0.00 | 3.92 | 3.92 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 3.92 |

| 94 | 74350T305 | 28061 | Prospect Enhanced Yield Fund – I | 2026-01-28 | 29980109.93 | 25.40 | 25.39 | 0.01 | 0.00 | 1.15 | 2.49 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 1.15 | 2.49 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| 93 | 74350T305 | 28061 | Prospect Enhanced Yield Fund – I | 2026-01-27 | 29975003.21 | 25.39 | 25.38 | 0.01 | 0.00 | 1.11 | 2.53 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 1.11 | 2.53 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| 92 | 74350T305 | 28061 | Prospect Enhanced Yield Fund – I | 2026-01-26 | 29966417.51 | 25.38 | 25.38 | 0.00 | 0.00 | 1.07 | 2.53 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 1.07 | 2.53 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| 91 | 74350T305 | 28061 | Prospect Enhanced Yield Fund – I | 2026-01-23 | 29958702.69 | 25.38 | 25.32 | 0.06 | 0.00 | 1.19 | 2.61 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 1.19 | 2.61 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| 90 | 74350T305 | 28061 | Prospect Enhanced Yield Fund – I | 2026-01-22 | 29892589.04 | 25.32 | 25.31 | 0.01 | 0.00 | 1.00 | 2.37 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 1.00 | 2.37 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| 89 | 74350T305 | 28061 | Prospect Enhanced Yield Fund – I | 2026-01-21 | 29884560.97 | 25.31 | 25.31 | 0.00 | 0.00 | 1.00 | 2.37 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 1.00 | 2.37 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| 88 | 74350T305 | 28061 | Prospect Enhanced Yield Fund – I | 2026-01-20 | 29877407.05 | 25.31 | 25.30 | 0.01 | 0.00 | 1.00 | 2.37 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 1.00 | 2.37 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| 87 | 74350T305 | 28061 | Prospect Enhanced Yield Fund – I | 2026-01-16 | 29868058.25 | 25.30 | 25.27 | 0.03 | 0.00 | 1.12 | 2.49 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 1.12 | 2.49 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| 86 | 74350T305 | 28061 | Prospect Enhanced Yield Fund – I | 2026-01-15 | 29834796.33 | 25.27 | 25.26 | 0.01 | 0.00 | 1.04 | 2.37 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 1.04 | 2.37 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| 85 | 74350T305 | 28061 | Prospect Enhanced Yield Fund – I | 2026-01-14 | 29816506.00 | 25.26 | 25.25 | 0.01 | 0.00 | 1.04 | 1.88 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 1.04 | 1.88 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| 84 | 74350T305 | 28061 | Prospect Enhanced Yield Fund – I | 2026-01-13 | 29811776.36 | 25.25 | 25.23 | 0.02 | 0.00 | 1.00 | 1.88 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 1.00 | 1.88 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| 83 | 74350T305 | 28061 | Prospect Enhanced Yield Fund – I | 2026-01-12 | 29778994.74 | 25.23 | 25.22 | 0.01 | 0.00 | 0.92 | 1.80 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.92 | 1.80 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| 82 | 74350T305 | 28061 | Prospect Enhanced Yield Fund – I | 2026-01-09 | 29770643.40 | 25.22 | 25.19 | 0.03 | 0.00 | 1.00 | 1.84 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 1.00 | 1.84 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| 81 | 74350T305 | 28061 | Prospect Enhanced Yield Fund – I | 2026-01-08 | 29732151.72 | 25.19 | 25.18 | 0.01 | 0.00 | 0.88 | 1.76 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.88 | 1.76 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| 80 | 74350T305 | 28061 | Prospect Enhanced Yield Fund – I | 2026-01-07 | 29723768.44 | 25.18 | 25.17 | 0.01 | 0.00 | 0.88 | 1.76 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.88 | 1.76 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| 79 | 74350T305 | 28061 | Prospect Enhanced Yield Fund – I | 2026-01-06 | 29715884.59 | 25.17 | 25.17 | 0.00 | 0.00 | 0.84 | 1.72 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.84 | 1.72 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| 78 | 74350T305 | 28061 | Prospect Enhanced Yield Fund – I | 2026-01-05 | 29707699.42 | 25.17 | 25.16 | 0.01 | 0.00 | 0.84 | 1.76 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.84 | 1.76 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| 77 | 74350T305 | 28061 | Prospect Enhanced Yield Fund – I | 2026-01-02 | 29698911.84 | 25.16 | 25.13 | 0.03 | 0.00 | 0.96 | 1.80 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.96 | 1.80 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| 76 | 74350T305 | 28061 | Prospect Enhanced Yield Fund – I | 2025-12-31 | 29472045.45 | 25.13 | 25.31 | -0.18 | 0.19 | 0.88 | 1.72 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.88 | 1.72 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| 75 | 74350T305 | 28061 | Prospect Enhanced Yield Fund – I | 2025-12-30 | 29686567.83 | 25.31 | 25.31 | 0.00 | 0.00 | 0.84 | 1.68 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.84 | 1.68 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| 74 | 74350T305 | 28061 | Prospect Enhanced Yield Fund – I | 2025-12-29 | 29678826.56 | 25.31 | 25.30 | 0.01 | 0.00 | 0.84 | 1.72 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.84 | 1.72 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| 73 | 74350T305 | 28061 | Prospect Enhanced Yield Fund – I | 2025-12-26 | 29672252.18 | 25.30 | 25.28 | 0.02 | 0.00 | 0.88 | 1.72 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.88 | 1.72 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| 72 | 74350T305 | 28061 | Prospect Enhanced Yield Fund – I | 2025-12-24 | 29648255.44 | 25.28 | 25.27 | 0.01 | 0.00 | 0.80 | 1.72 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.80 | 1.72 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| 71 | 74350T305 | 28061 | Prospect Enhanced Yield Fund – I | 2025-12-23 | 29632031.58 | 25.27 | 25.26 | 0.01 | 0.00 | 0.80 | 1.68 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.80 | 1.68 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| 70 | 74350T305 | 28061 | Prospect Enhanced Yield Fund – I | 2025-12-22 | 29623799.74 | 25.26 | 25.25 | 0.01 | 0.00 | 0.76 | 1.72 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.76 | 1.72 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| 69 | 74350T305 | 28061 | Prospect Enhanced Yield Fund – I | 2025-12-19 | 29616145.80 | 25.25 | 25.23 | 0.02 | 0.00 | 0.56 | 1.76 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.56 | 1.76 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| 68 | 74350T305 | 28061 | Prospect Enhanced Yield Fund – I | 2025-12-18 | 29592864.01 | 25.23 | 25.23 | 0.00 | 0.00 | 0.48 | 1.76 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.48 | 1.76 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| 67 | 74350T305 | 28061 | Prospect Enhanced Yield Fund – I | 2025-12-17 | 29585182.15 | 25.23 | 25.21 | 0.02 | 0.00 | 0.52 | 1.76 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.52 | 1.76 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| 66 | 74350T305 | 28061 | Prospect Enhanced Yield Fund – I | 2025-12-16 | 29568420.85 | 25.21 | 25.20 | 0.01 | 0.00 | 0.48 | 1.72 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.48 | 1.72 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| 65 | 74350T305 | 28061 | Prospect Enhanced Yield Fund – I | 2025-12-15 | 29555954.69 | 25.20 | 25.19 | 0.01 | 0.00 | 0.44 | 1.68 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.44 | 1.68 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| 64 | 74350T305 | 28061 | Prospect Enhanced Yield Fund – I | 2025-12-12 | 29547940.19 | 25.19 | 25.18 | 0.01 | 0.00 | 0.44 | 1.68 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.44 | 1.68 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| 63 | 74350T305 | 28061 | Prospect Enhanced Yield Fund – I | 2025-12-11 | 29525179.00 | 25.18 | 25.17 | 0.01 | 0.00 | 0.40 | 1.68 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.40 | 1.68 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| 62 | 74350T305 | 28061 | Prospect Enhanced Yield Fund – I | 2025-12-10 | 29519850.43 | 25.17 | 25.16 | 0.01 | 0.00 | 0.40 | 1.68 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.40 | 1.68 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| 61 | 74350T305 | 28061 | Prospect Enhanced Yield Fund – I | 2025-12-09 | 29512377.61 | 25.16 | 25.16 | 0.00 | 0.00 | 0.40 | 1.64 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.40 | 1.64 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| 60 | 74350T305 | 28061 | Prospect Enhanced Yield Fund – I | 2025-12-08 | 29504801.35 | 25.16 | 25.15 | 0.01 | 0.00 | 0.40 | 1.68 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.40 | 1.68 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| 59 | 74350T305 | 28061 | Prospect Enhanced Yield Fund – I | 2025-12-05 | 29496725.98 | 25.15 | 25.13 | 0.02 | 0.00 | 0.52 | 1.64 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.52 | 1.64 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| 58 | 74350T305 | 28061 | Prospect Enhanced Yield Fund – I | 2025-12-04 | 29471586.21 | 25.13 | 25.12 | 0.01 | 0.00 | 0.48 | 1.60 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.48 | 1.60 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| 57 | 74350T305 | 28061 | Prospect Enhanced Yield Fund – I | 2025-12-03 | 29464127.11 | 25.12 | 25.11 | 0.01 | 0.00 | 0.48 | 1.60 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.48 | 1.60 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| 56 | 74350T305 | 28061 | Prospect Enhanced Yield Fund – I | 2025-12-02 | 29453616.66 | 25.11 | 25.11 | 0.00 | 0.00 | 0.48 | 1.56 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.48 | 1.56 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| 55 | 74350T305 | 28061 | Prospect Enhanced Yield Fund – I | 2025-12-01 | 29445385.57 | 25.11 | 25.10 | 0.01 | 0.00 | 0.48 | 1.60 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.48 | 1.60 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| 54 | 74350T305 | 28061 | Prospect Enhanced Yield Fund – I | 2025-11-28 | 29245501.76 | 25.10 | 25.27 | -0.17 | 0.19 | 0.52 | 1.60 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.52 | 1.60 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| 53 | 74350T305 | 28061 | Prospect Enhanced Yield Fund – I | 2025-11-26 | 29443964.89 | 25.27 | 25.26 | 0.01 | 0.00 | 0.56 | 1.56 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.56 | 1.56 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| 52 | 74350T305 | 28061 | Prospect Enhanced Yield Fund – I | 2025-11-25 | 29429184.88 | 25.26 | 25.27 | -0.01 | 0.00 | 0.52 | 1.56 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.52 | 1.56 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| 51 | 74350T305 | 28061 | Prospect Enhanced Yield Fund – I | 2025-11-24 | 29441071.01 | 25.27 | 25.26 | 0.01 | 0.00 | 0.56 | 1.60 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.56 | 1.60 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| 50 | 74350T305 | 28061 | Prospect Enhanced Yield Fund – I | 2025-11-21 | 29433859.15 | 25.26 | 25.24 | 0.02 | 0.00 | 0.64 | 1.60 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.64 | 1.60 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| 49 | 74350T305 | 28061 | Prospect Enhanced Yield Fund – I | 2025-11-20 | 29411591.64 | 25.24 | 25.30 | -0.06 | 0.00 | 0.56 | 1.56 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.56 | 1.56 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| 48 | 74350T305 | 28061 | Prospect Enhanced Yield Fund – I | 2025-11-19 | 29479436.58 | 25.30 | 25.30 | 0.00 | 0.00 | 0.83 | 1.80 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.83 | 1.80 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| 47 | 74350T305 | 28061 | Prospect Enhanced Yield Fund – I | 2025-11-18 | 29472118.22 | 25.30 | 25.29 | 0.01 | 0.00 | 0.83 | 1.84 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.83 | 1.84 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| 46 | 74350T305 | 28061 | Prospect Enhanced Yield Fund – I | 2025-11-17 | 29464498.53 | 25.29 | 25.28 | 0.01 | 0.00 | 0.79 | 1.80 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.79 | 1.80 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| 45 | 74350T305 | 28061 | Prospect Enhanced Yield Fund – I | 2025-11-14 | 29456909.66 | 25.28 | 25.26 | 0.02 | 0.00 | 0.44 | 1.80 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.44 | 1.80 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| 44 | 74350T305 | 28061 | Prospect Enhanced Yield Fund – I | 2025-11-13 | 29434146.25 | 25.26 | 25.27 | -0.01 | 0.00 | 0.40 | 1.72 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.40 | 1.72 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| 43 | 74350T305 | 28061 | Prospect Enhanced Yield Fund – I | 2025-11-12 | 29445310.22 | 25.27 | 25.27 | 0.00 | 0.00 | 0.44 | 1.80 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.44 | 1.80 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| 42 | 74350T305 | 28061 | Prospect Enhanced Yield Fund – I | 2025-11-11 | 29438072.24 | 25.27 | 25.26 | 0.01 | 0.00 | 0.44 | 1.80 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.44 | 1.80 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| 41 | 74350T305 | 28061 | Prospect Enhanced Yield Fund – I | 2025-11-10 | 29430914.26 | 25.26 | 25.25 | 0.01 | 0.00 | 0.40 | 1.76 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.40 | 1.76 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| 40 | 74350T305 | 28061 | Prospect Enhanced Yield Fund – I | 2025-11-07 | 29424239.74 | 25.25 | 25.22 | 0.03 | 0.00 | 0.52 | 1.76 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.52 | 1.76 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| 39 | 74350T305 | 28061 | Prospect Enhanced Yield Fund – I | 2025-11-06 | 29380355.71 | 25.22 | 25.21 | 0.01 | 0.00 | 0.40 | 1.64 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.40 | 1.64 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| 38 | 74350T305 | 28061 | Prospect Enhanced Yield Fund – I | 2025-11-05 | 29367901.66 | 25.21 | 25.20 | 0.01 | 0.00 | 0.40 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.40 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| 37 | 74350T305 | 28061 | Prospect Enhanced Yield Fund – I | 2025-11-04 | 29361138.31 | 25.20 | 25.19 | 0.01 | 0.00 | 0.36 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.36 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| 36 | 74350T305 | 28061 | Prospect Enhanced Yield Fund – I | 2025-11-03 | 29353889.13 | 25.19 | 25.18 | 0.01 | 0.00 | 0.32 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.32 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| 35 | 74350T305 | 28061 | Prospect Enhanced Yield Fund – I | 2025-10-31 | 29141193.72 | 25.18 | 25.36 | -0.18 | 0.19 | 0.40 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.40 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| 34 | 74350T305 | 28061 | Prospect Enhanced Yield Fund – I | 2025-10-30 | 29351800.23 | 25.36 | 25.36 | 0.00 | 0.00 | 0.36 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.36 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| 33 | 74350T305 | 28061 | Prospect Enhanced Yield Fund – I | 2025-10-29 | 29349813.20 | 25.36 | 25.35 | 0.01 | 0.00 | 0.40 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.40 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| 32 | 74350T305 | 28061 | Prospect Enhanced Yield Fund – I | 2025-10-28 | 27943022.01 | 25.35 | 25.33 | 0.02 | 0.00 | 0.40 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.40 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| 31 | 74350T305 | 28061 | Prospect Enhanced Yield Fund – I | 2025-10-27 | 26070749.01 | 25.33 | 25.32 | 0.01 | 0.00 | 0.32 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.32 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| 30 | 74350T305 | 28061 | Prospect Enhanced Yield Fund – I | 2025-10-24 | 26063781.86 | 25.32 | 25.30 | 0.02 | 0.00 | 0.36 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.36 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| 29 | 74350T305 | 28061 | Prospect Enhanced Yield Fund – I | 2025-10-23 | 26044046.39 | 25.30 | 25.30 | 0.00 | 0.00 | 0.28 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.28 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| 28 | 74350T305 | 28061 | Prospect Enhanced Yield Fund – I | 2025-10-22 | 26037296.01 | 25.30 | 25.29 | 0.01 | 0.00 | 0.36 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.36 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| 27 | 74350T305 | 28061 | Prospect Enhanced Yield Fund – I | 2025-10-21 | 25530837.95 | 25.29 | 25.29 | 0.00 | 0.00 | 0.40 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.40 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| 26 | 74350T305 | 28061 | Prospect Enhanced Yield Fund – I | 2025-10-20 | 25525159.24 | 25.29 | 25.28 | 0.01 | 0.00 | 0.40 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.40 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| 25 | 74350T305 | 28061 | Prospect Enhanced Yield Fund – I | 2025-10-17 | 25518603.64 | 25.28 | 25.25 | 0.03 | 0.00 | 0.44 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.44 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| 24 | 74350T305 | 28061 | Prospect Enhanced Yield Fund – I | 2025-10-16 | 25491597.38 | 25.25 | 25.25 | 0.00 | 0.00 | 0.36 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.36 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| 23 | 74350T305 | 28061 | Prospect Enhanced Yield Fund – I | 2025-10-15 | 25485122.84 | 25.25 | 25.36 | -0.11 | 0.00 | 0.36 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.36 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| 22 | 74350T305 | 28061 | Prospect Enhanced Yield Fund – I | 2025-10-14 | 25598354.39 | 25.36 | 25.35 | 0.01 | 0.00 | 0.83 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.83 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| 21 | 74350T305 | 28061 | Prospect Enhanced Yield Fund – I | 2025-10-13 | 25591963.57 | 25.35 | 25.35 | 0.00 | 0.00 | 0.80 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.80 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| 20 | 74350T305 | 28061 | Prospect Enhanced Yield Fund – I | 2025-10-10 | 25585760.67 | 25.35 | 25.33 | 0.02 | 0.00 | 0.88 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.88 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| 19 | 74350T305 | 28061 | Prospect Enhanced Yield Fund – I | 2025-10-09 | 25566138.93 | 25.33 | 25.32 | 0.01 | 0.00 | 0.80 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.80 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| 18 | 74350T305 | 28061 | Prospect Enhanced Yield Fund – I | 2025-10-08 | 25560137.70 | 25.32 | 25.31 | 0.01 | 0.00 | 0.80 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.80 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| 17 | 74350T305 | 28061 | Prospect Enhanced Yield Fund – I | 2025-10-07 | 25554013.13 | 25.31 | 25.31 | 0.00 | 0.00 | 0.76 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.76 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| 16 | 74350T305 | 28061 | Prospect Enhanced Yield Fund – I | 2025-10-06 | 25548087.54 | 25.31 | 25.30 | 0.01 | 0.00 | 0.76 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.76 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

Past performance is neither indicative nor a guarantee of future results.

Fund Terms

| Fund | Prospect Enhanced Yield Fund, Inc. |

| Structure | 1940 Act Interval Fund |

| Adviser | Prospect Enhanced Yield Management, LLC |

| Strategy | U.S. focused Collateralized Loan Obligations and Other ABS |

| Share Class (Ticker / CUSIP) | – Class I (PAYIX / 74350T 305) – Class A (PAYAX / 74350T 107) – Class C (PAYCX / 74350T 206) |

| Minimum Commitment | – $2,500 (Class A & Class C) – $500,000 (Class I) |

| Target Fund Size | $1.0 Billion |

| NAV Frequency | Daily |

| Distribution Frequency | Monthly |

| Liquidity4 | Minimum 5.0% Quarterly Repurchases of Shares Outstanding at NAV |

| Fee Structure | – Base Management and Incentive Fees waived until December 31, 2026. – Base Management Fee: 1.375% on Total Assets – Incentive Fee: 15.0% of Net Investment Income, subject to a hurdle of 7.0% and a catch-up. |

Adviser has entered into an Expense Limitation Agreement pursuant to which it will reimburse the Fund, to limit Operating Expenses to an Annual Limit of 2.00% of Net Assets until December 31, 2026, subject to recoupment by the Adviser within three years.5 Adviser has additionally agreed to reimburse Operating Expenses up to the Annual Limit of 2.00% of Net Assets until December 31, 2026. Total Annual Expense Ratio for each class is as follows: Class I: 6.28% Gross (estimated)/0.00% Net; Class A: 6.53% Gross (estimated)/0.25% Net; and Class C: 7.28% Gross (estimated)/1.00% Net.

Our Team

M. Grier Eliasek

President & chief executive officer

Mr. Eliasek has served as a portfolio manager of the Fund since its inception. Mr. Eliasek currently serves as President and Chief Executive Officer of our Adviser, as a Managing Director of our Administrator, as President, Co-Founder and Chief Operating Officer of PSEC, as President and Chief Operating Officer of Prospect Flexible Income Management, LLC and Chairman of the Board of Trustees, Chief Executive Officer and President of PFLOAT. He also serves on the Board of Trustees for PSEC and leads each of Prospect Capital Management’s investment committees in the origination, selection, monitoring and portfolio management of investments.

Prior to joining Prospect Capital Management in 2004, Mr. Eliasek served as a Managing Director with Prospect Street Ventures, an investment management firm which, together with its predecessors, invested in various investment strategies through publicly traded closed-end funds and private limited partnerships. Prior to joining Prospect Street Ventures, Mr. Eliasek served as a consultant with Bain & Company, a global strategy consulting firm.

Mr. Eliasek received his MBA from Harvard Business School and his Bachelor of Science degree in Chemical Engineering with Highest Distinction from the University of Virginia, where he was a Jefferson Scholar and a Rodman Scholar.

Josh Soffer

Managing director

Mr. Soffer has served as a portfolio manager of the Fund since its inception. Mr. Soffer is a Principal of our Adviser and has been in the finance industry since 2004. He is responsible for originating, executing, and managing investments in CLOs and CMBS.

From 2018 to 2021, Mr. Soffer was a co-founder and portfolio manager of 1L Investments, a securitized products hedge fund. From 2011 to 2016, he was co-founder and co-chief investment officer of Rion Capital, a fixed income relative value hedge fund specializing in securitized products. Mr. Soffer also held positions in trading and portfolio management at Level Global Investors, UBS AG and AVM LP. He began his career at Merrill Lynch Investment Management.

Mr. Soffer received his BA from the University of Pennsylvania.

National Accounts Team Regional Coverage Map

Endnotes

- Distributions are not guaranteed. There is no assurance that distributions will be made or that any particular rate of distribution will be maintained. Distributions are intended to be paid monthly as authorized by the Board of Directors. The annualized distribution rate is based on the current offering price of a share class, and is calculated by annualizing the monthly common share distributions. ↩︎

- Guggenheim Investments, “The ABCs of Asset-Backed Securities (ABS)”, 04/03/2023. ↩︎

- “Other” investments may include, but is not limited to, securitizations backed by credit cards, fiber optic cable lines, equipment, and whole businesses. ↩︎

- We intend to limit the number of shares to be repurchased in any calendar quarter to 5% of the number of shares outstanding, priced at NAV as of the close of regular trading on the NYSE on the Repurchase Pricing Date. ↩︎

- “Operating Expenses” with respect to the Fund, is defined to include all expenses necessary or appropriate for the operation of the Fund, including but not limited to any and all costs and expenses that qualify as line item “organization and offering” expenses in the financial statements of the Fund as the same are filed with the SEC and other expenses described in the Investment Advisory Agreement, but does not include the Adviser’s base management fee and incentive fee, any portfolio transaction or other investment-related costs (including brokerage commissions, dealer and underwriter spreads, prime broker fees and expenses and dividend expenses related to short sales), distribution and shareholder servicing fees, interest expenses and other financing costs, extraordinary expenses and acquired fund fees and expenses. Amounts waived by the Adviser are subject to reimbursement to the Advisor for a period of up to three years of the date of on which the waiver was made, subject to the terms and conditions of the expense limitation agreement. ↩︎

Disclaimers

Investors should consider the investment objectives, risks, and charges and expenses of the Fund(s) before investing. The prospectus contains this and other information about the Fund(s) and should be read carefully before investing. The prospectus may be obtained at our Toll-Free number 833-404-2747 or at ProspectEnhanced.com.

All investments involve risk, including the risk of loss of all or a portion of the invested amount. Any investment is subject to a variety of risks and there can be no assurance that any investment will meet its investment objectives, if any, or that investors will not incur losses.

The Prospect Enhanced Yield Fund is distributed by Ultimus Fund Distributors, LLC, Member FINRA/SIPC.

Important Risk Factors to Consider

An investment in shares of the Fund involve a high degree of risk and may be considered speculative. You should carefully consider the information found in “Important Risk Factors to Consider” before deciding to invest in our shares. The following are some of the risks an investment in us involves:

- Global economic, political, or financial market conditions including changes in interest rates or economic recessions or downturns

- Limited liquidity and lack of transferability

- Reinvestment risk

- No assurance that distributions will be made or that any particular rate of distributions will be maintained

- Risk that the Fund’s operating results will be affected by economic and regulatory changes, including legislative change to taxes

- Risks related to failing to qualify as a regulated investment company for U.S. federal income tax purposes

- Exposure to leveraged credit risk and interest rate risk

- Potential uncertainty as to the value of the Fund’s assets

- Structured credit securities involve certain risks in addition to the general risks typically associated with investing in debt securities

- Risks associated with ABS investments including default, valuation, prepayment, extension, and interest rate risk

- Interruption and deferral of cashflow to our investments in structured credit instruments

- Risks related to the CLO primary market including negative market environments hampering a CLO collateral manager’s ability to meet diversification

- Investments in foreign securities may involve significant risks in addition to the risks inherent in U.S. securities

- Investment concentration risk

- CLOs typically will have no significant assets other than their underlying Senior Secured Loans

- Risk associated with credit derivatives including liquidity, volatility, pricing, leverage, and credit risks of the underlying assets and counterparty

- Risks associated with CMBS investments including lack of standardized terms, maturity, and repayment risks

- Our investments in Target Securities may be illiquid.

- May invest in assets with limited or no performance or operating history

- Risks associated with lending activities, including underlying borrower fraud and risk of increased leverage

- Non-investment grade debt involves a greater risk of default and higher price volatility than investment grade debt

- Absence of investments identified for acquisition

- Payment of significant fees to the Fund’s Adviser and its affiliates

- Potential Conflicts of Interest

- Risk of investment professional turnover

- Restricted entry into transactions with our affiliates

- Ability to invest net proceeds on acceptable terms in an acceptable timeframe

- Purchasers of our shares are subject to dilution as a result of expenses we will incur in connection with this offering. In addition, we intend to continue to issue shares, which subjects your ownership percentage in us to further dilution.

These and other risks may impact the Fund’s financial condition, operating results, returns to its investors, and ability to make distributions as stated in the Fund’s prospectus.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED ANY OFFERING OF PROSPECT ENHANCED YIELD FUND ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

This material is not intended to be a recommendation or investment advice, does not constitute a solicitation to buy or sell securities, and is not provided in a fiduciary capacity. AN OFFERING IS MADE ONLY BY THE PROSPECTUS. THIS MATERIAL MUST BE PRECEDED OR ACCOMPANIED BY A PROSPECTUS. YOU SHOULD READ THE PROSPECTUS IN ORDER TO UNDERSTAND FULLY ALL OF THE IMPLICATIONS AND RISKS OF THE OFFERING OF SECURITIES TO WHICH IT RELATES. The information provided does not take into account the specific objectives or circumstances of any particular investor or suggest any specific course of action. Investment decisions should be made based on an investor’s objectives and circumstances and in consultation with his or her advisors.